Give More Without Spending More

Cash is not the only way to give. If you hold investments that have grown in value, donating stock or giving through a donor-advised fund can be a tax-efficient way to support the AIP BIPOC Network without increasing out-of-pocket spending.

Many donors default to cash or card, but supporters can also give using appreciated stock, ETFs, crypto, or funds already set aside in a donor-advised fund. These options allow donors to recommend a charitable gift while helping nonprofits build more stable, long-term support.

Why Donating Stock Can Be Smart

If you sell appreciated stock before donating, you may owe capital gains tax.

When you donate the stock directly instead, you can:

- Avoid capital gains tax on the appreciation

- Keep more value in your charitable gift

- Potentially qualify for a deduction on the full fair market value

This can increase the actual impact of the donation without increasing what you spend. This is not financial advice. It is simply an option worth understanding as part of your giving strategy.

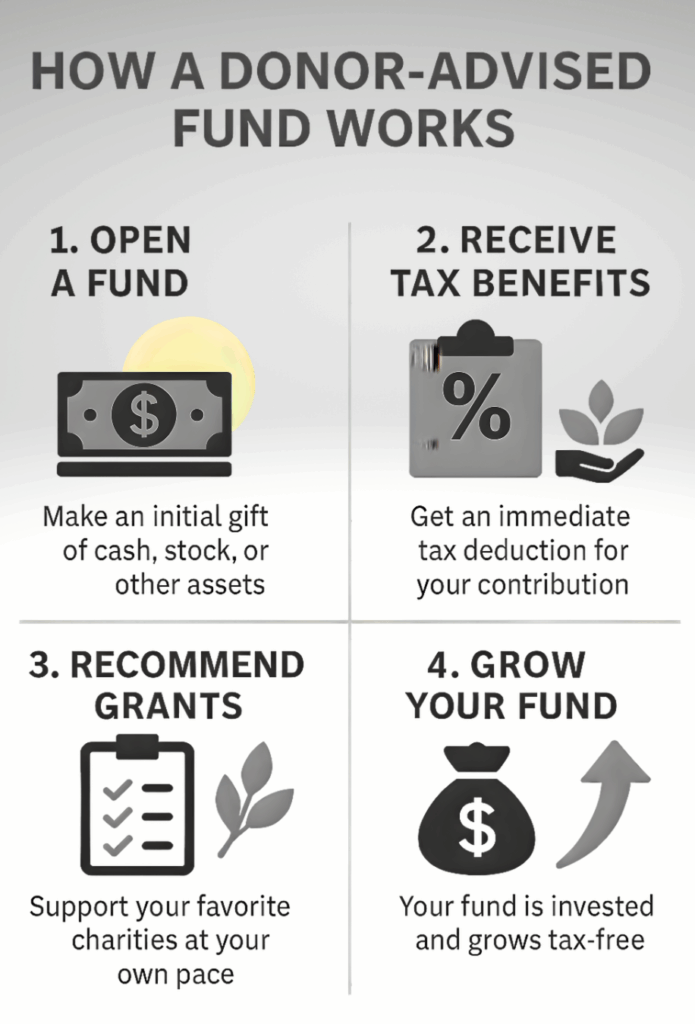

What Is a Donor Advised Fund (DAF)?

A Donor Advised Fund, or DAF, is a charitable investment account that holds assets meant for giving. You can contribute cash, stock, or other assets to the account and, if eligible, receive a tax deduction in that year. You then recommend grants to nonprofits over time.

People choose DAFs to:

- Consolidate charitable giving

- Capture tax benefits during high-income years

- Donate appreciated investments without selling first

- Support multiple nonprofits from one place

Common DAF providers include Schwab Charitable, Vanguard Charitable, and Fidelity Charitable.

Why This Matters With Current Tax Laws

The current federal tax rules increased the standard deduction. Because of that, fewer people itemize. Many donors look for methods that still create tax benefits without adding financial pressure.

For some donors, strategies like donating appreciated stock or using a DAF can:

- Make giving more affordable

- Increase the net value of a gift

- Support long-term giving plans

What Your Donation Supports

Your gift fuels our mission to improve the quality of life for the BIPOC autoimmune community through a five pillar framework:

Awareness

Education, resources, and lived-experience storytelling that help people understand autoimmune symptoms earlier and with more confidence.

Advocacy

Pushing for change in healthcare access, policy, resource distribution, and protections for people navigating chronic illness in systems that overlook BIPOC communities.

Action

Hands-on programs like ROCK Wellness Weekend, roundtables, health navigation workshops, fitness and movement classes, and direct community care.

Assessment

Tracking outcomes, barriers, patient experience, and needs so programs are built from evidence instead of assumptions. Data guides decisions.

Alignment

Strategic partnerships with providers, health systems, organizations, and advocates to unify efforts, prevent duplication, and get resources to the right communities.

Every gift strengthens this framework and directly supports community access, prevention, and equity.

Who Benefits From Stock Donations

This giving option is worth considering if you:

- Invest regularly

- Have appreciated assets

- Want to avoid capital gains on growth

- Use or plan to use a DAF

- Prefer non-cash giving strategies

Even small transfers can make a meaningful difference.

Frequently Asked Questions

Do I need to sell the stock first?

No. Donate the shares directly. Selling first can create capital gains tax.

Is donating stock tax deductible?

It can be. Many donors receive a deduction for the fair market value of the stock if they itemize. This is not financial advice. Confirm with a tax professional.

What is a Donor Advised Fund (DAF)?

A DAF is a charitable account for giving. You add assets and make grant recommendations to nonprofits over time. Some donors use DAFs to manage yearly giving and tax planning.

Can I use my DAF to support The AIP BIPOC Network?

Yes. Fidelity Charitable, Schwab Charitable, and Vanguard Charitable can usually send grants to us.

What investments can I donate?

Most common stocks and ETFs. Some platforms also accept crypto. Availability depends on the brokerage.

How fast does a stock donation process?

Usually within a few business days, depending on your brokerage.

Why donate stock instead of cash?

It can reduce capital gains tax, preserve more value in the gift, and support nonprofits at a lower personal cost.

Ready to Get Started?

Ready to Get Started?

Use the options above to donate stock or recommend a grant through your donor-advised fund.

If you have questions about the donation process, your brokerage or donor-advised fund provider can assist directly.

For tax or financial guidance, consult your tax advisor to determine what’s best for your situation.

Thank you for considering a giving option that supports long-term impact.

Jamie Nicole is the Founder and CEO of The AIP BIPOC Network. She is a Certified AIP Coach, patient advocate, and fitness instructor living with multiple autoimmune conditions. Jamie is committed to advancing equity, access, and representation for Black, Indigenous, and People of Color navigating autoimmune and chronic illness. Through education, advocacy, movement, and community-driven initiatives, she works to ensure BIPOC voices are centered in healthcare conversations and solutions.

Leave a Reply

© 2026 The AIP BIPOC Network, INc | EIN # 92-2526059 | all rights reserved | legal